While Planning, Provide Care for Your Pet?

The best way to take precautions and ensure your pet will be well cared for is by doing some estate planning.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Blog

The best way to take precautions and ensure your pet will be well cared for is by doing some estate planning.

Contesting a will simply means that you formally object to the terms and validity of the will.

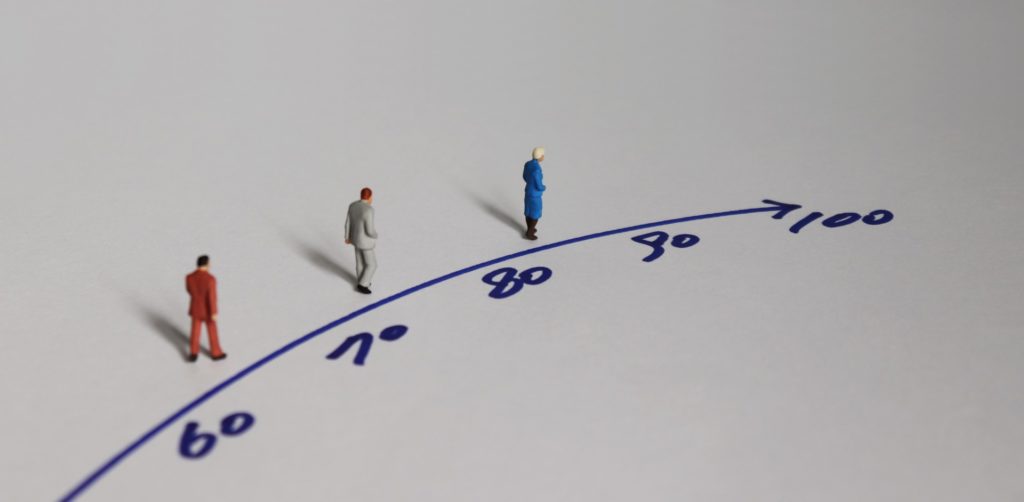

If 50 is the new 30, and 60 is the new 40, then 70 is the New What? As baby boomers (born 1946 to 1964) have aged, how we see turning a certain age has also changed.

You know that you can always refuse life-sustaining medical treatment. The tricky part comes when you are no longer able to understand your options or communicate your wishes to the health care professionals.

This time of the year is a great time to revisit your estate plan so you can ensure your legacy is protected for years to come.

This undesired streak marks the first time in 100 years the life expectancy in the U.S. has declined for three or more consecutive years.

The number of baby boomers entering retirement is expected to grow for several years, while the number of college-bound high-school grads is projected to decline.

We have all heard the term “probate.” However, we may not be exactly sure what this means. It may sound daunting, but don’t be intimidated by the phrase.

These changes are so significant that plan holders should review their wishes and how their estate plans may be affected.

Estate planning is a systematic process, which involves getting your personal and financial goals for the time you pass away or become mentally incapacitated. It is also known as a last will, and almost everyone does this planning for their family.