Ignoring Beneficiary Designations Is a Risky Business

We are programmed to contribute the “max” to our retirement accounts, but we disregard, or do not understand, the pitfalls of improperly filled-out beneficiary forms.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Living Trust • Page 4

We are programmed to contribute the “max” to our retirement accounts, but we disregard, or do not understand, the pitfalls of improperly filled-out beneficiary forms.

It was reported on the news recently that some of Aretha Franklin’s family members have found what they believe to be her will. It was handwritten, stained, and crumpled up in a couch. The courts may or may not choose to honor it, depending on whether or not they are able to verify its authenticity.

In my parents’ trust, they leave each other their share upon death, and then I become trustee when my last parent dies. I’m really concerned about this whole deal.

Do not put off finalizing and signing your estate planning documents just because you have reached an impasse on who to name as trustee.

A trust can be a vital component in an estate plan.

My mom wants to leave her house to me, since I’m the only girl. My brothers may try and contest this in probate court. What can my mom do to be sure I receive ownership of the house upon her death?

While everyone from brand new parents to great grandparents can benefit from the advice of a competent estate planning lawyer, frequently the individuals making sure that their affairs are in order, are those in their golden years. They have a common concern: what about their grandbabies?

Fortunately, Perry’s foresight to do proper estate planning, meant that the tragedy was not made worse for his family.

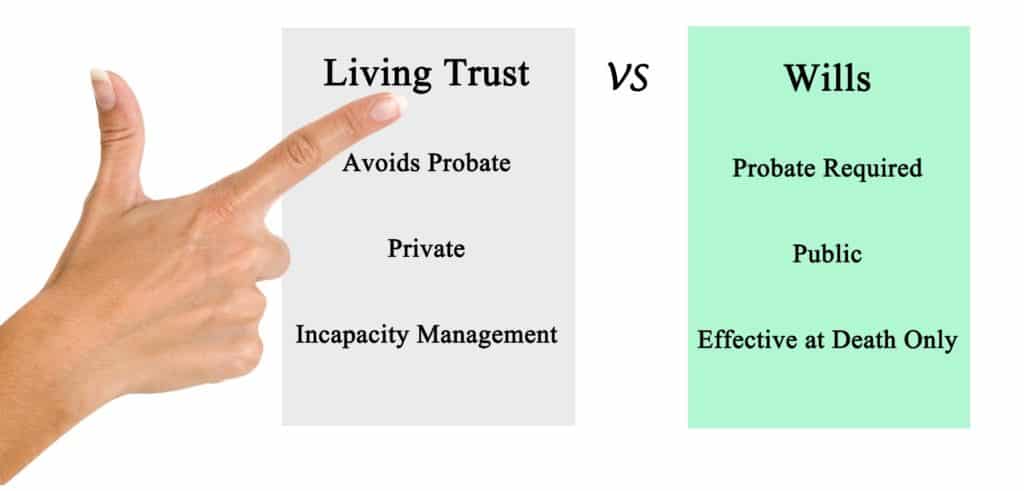

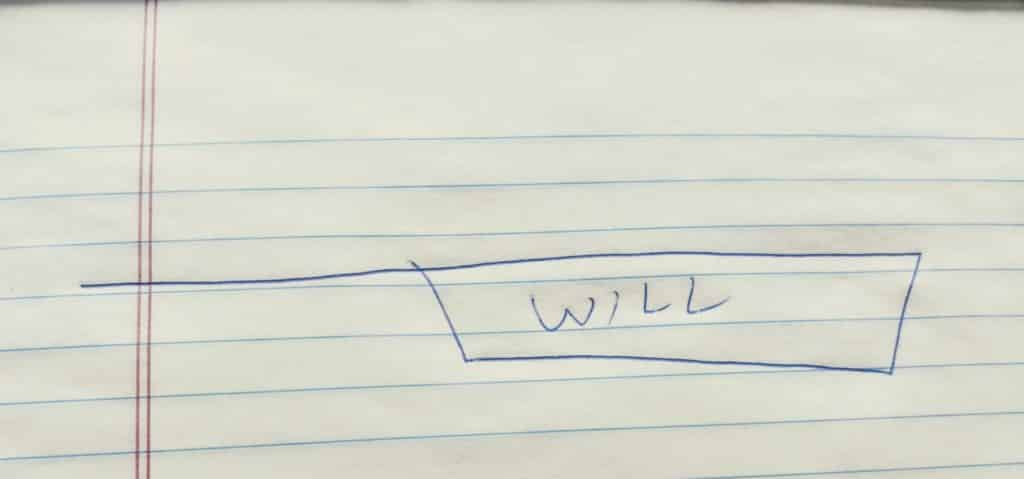

Probate is what’s left over When someone dies, property will be transferred from them to someone else by Title or Contract. One form of trust transfer is a Revocable Living Trust. When I think of a Trust, I picture a “Box” to take the title of the property. Assets transferred into the trust, or “Funded into the Trust”, do not need to be transferred through the probate process, because the death of the Trust creator does not affect the title of the property. The idea is to put the property into the box while you are alive. If you do so, where is the title when you die? It’s in the Trust, just as it was before death. Probate is not needed to help change title. However, a Living Trust is not a magic box. It will only avoid court for assets that are transferred to it. To avoid Court, you must do work: you need to dedicate the time, effort and persistence required to transfer the titles. For most banks, account numbers stay the same. The checks don’t need to say “Trust” on them as long as the statements do. The account will still be in your social security number, as the trust is not separate taxpayer while the Grantor is living. Not all assets get funded into a Trust. Assets such as Life Insurance, retirement plans, deferred compensation accounts, thrift savings plans, and annuities are handled by beneficiary designation and are not transferred into a revocable trust. Automobiles are not usually transferred into a Trust. We estimate that most of our clients spend 20 to 30 hours on the funding process, mostly in filling in new account forms and waiting for bank personnel to figure out how to do what you are asking. You can take consolation in this: if you don’t go through this effort, your chosen loved one who is named executor will be doing so. A large part of the gift a trust represents to the family is that you spend the time and effort, so they don’t have to. It also means revising deeds so that the titled owner is the Trust. When someone dies, we meet with the successor trustee, and are focused on what the titles say, and who are designated beneficiaries on the contracts. That is where the rubber meets the road. What if things are missed. We create a short will, called a “Pour over Will” to catch loose ends which get missed in the funding process. The Will simply says “Put the probate assets into the trust” in legal mumbo jumbo. To use this type Will, you need to go to the probate court and open a probate filing. In Maryland, for estates of under $50,000, the process is relatively simple and is often opened and shut on the same day. A significant added bonus to a living trust is that is works very well to allow management of assets if you are no longer able to do so. But

Probate is what’s left over I draw about ten frying pans a week on a legal pad. This is not due to my great artist ability. Last week I explained that Wills work through a process called Probate. When someone dies, property may be transferred by title, such as the transfer of a house to a spouse when the first spouse dies. It is easy and essentially automatic. If a person dies and the title doesn’t convey ownership, then a contract may do so instead. More about that next week. There are only three ways assets transfer at death: By Title, by Contract, or by Probate. If the title and contract don’t transfer ownership, then a probate estate does. If a decedent as a will, this is activated then: if not, then the law of the state of they lived in writes one for them. Since the dead person is not here to transfer title, that role is given to the Personal Representative. Once appointed, that person can sign contracts, deeds, tax returns, etc. All this is done with the oversight of the probate Court. Probate is not bad: it serves a necessary function. Many year ago, I was part of a bar association discussion years ago about probate and its avoidance. I was advocating the use of Revocable Living Trusts as reasonable alternatives to Court supervised transfers. I felt like a baby harp seal hunter at a PETA meeting. The outrage and venom directed at me for suggesting that Probate was to be avoided” were palpable. Most of the lawyers present, and the then Register of Wills, insisted as a strong refrain that “Probate is not that bad…” The only people I have heard insist that this is true are attorneys and Probate Court personnel. I pointed out the hypocrisy of this by position by asking “How many of you have your life insurance policies and/or retirement plans payable to their probate estates?” Of course, no one did so, because naming a beneficiary was simple and the probate Court could be avoided. If probate isn’t so bad, then why no? Maybe because of administrative fees, Court costs, Attorney fees, Personal Representative Commissions, which in Maryland can be 3.6% to 4%. Maybe because the court process can cause long delays before funds are available: from seven months to several years is not unusual. Finally Probate records are public, meaning that your neighbor can go to the Court, read your will, find out who is getting what, when they get it, and who is in control. For some of my clients, keeping this private is preferable. Is short, probate is time consuming, expensive and is completely public. The Court process provides supervision, which is some cases is badly needed. Most of my clients name people that they trust and don’t want supervised. To weigh out your options, its best to seek the advice of an estate planning attorney. Note: This is the Second of a Series of Five to be published