What Assets are in an Estate?

This is an important question to ask, because the answer could tell you whether you need to worry about estate taxes, beneficiary issues or probate concerns.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Retirement Plans • Beneficiary Designations • Page 2

This is an important question to ask, because the answer could tell you whether you need to worry about estate taxes, beneficiary issues or probate concerns.

If you’ve had an IRA and a 401(k) for many years, you may occasionally ask yourself some questions: ‘Am I contributing enough?’ ‘Am I still funding these accounts with the right mix of investments for my goals and risk tolerance?

This legal document can also be beneficial in many situations, such as if you want to leave an inheritance to someone but aren’t sure they will use the gift wisely.

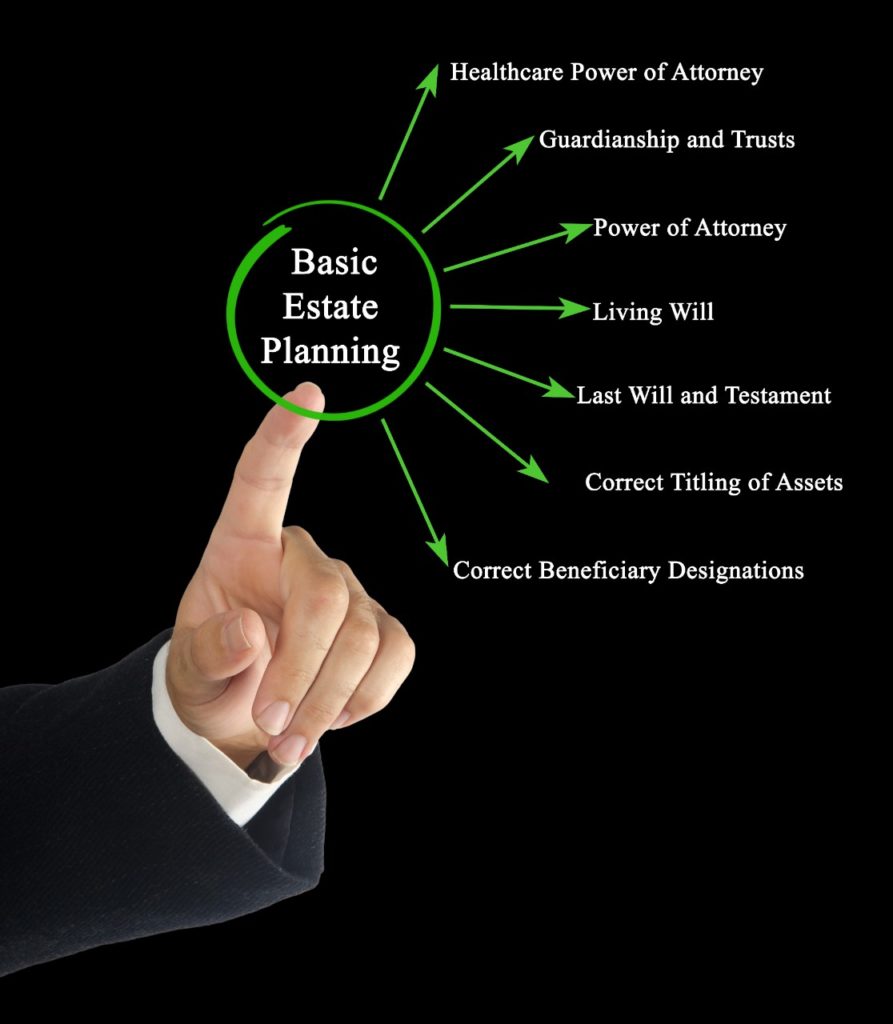

Estate planning is a cornerstone of any healthy financial plan, but it can be difficult to discuss.

So, you inherited a retirement account. Before you make any decisions on when and how to access the money, it’s worth familiarizing yourself with the rules that apply to different beneficiaries.

When an estate is named beneficiary of an IRA, what is the method of distributing it to one individual in the most tax-effective way?

Beneficiary mistakes can result in retirement plan assets being transferred to unintended beneficiaries.

One wrong decision can lead to expensive consequences, and good luck trying to persuade the IRS to give you a do-over.

When you open a financial account, you’re often asked to name a beneficiary. Simply stated, a beneficiary is someone who is entitled to the benefits of the account on the death of the account holder. For example, if you’ve purchased life insurance, you name a beneficiary who receives the benefits of the policy when you pass away.

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.