Should I Designate a Trust as a Beneficiary of My IRA?

The question becomes, should they name a trust rather than an individual as a beneficiary of the IRA?

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Retirement Plans • Beneficiary Designations • Page 4

The question becomes, should they name a trust rather than an individual as a beneficiary of the IRA?

When you have finally decided to move from home to a senior retirement community that has levels of care—or when moving to a personal care/assisted living community—you and your family might not be in the mood to read legal agreements.

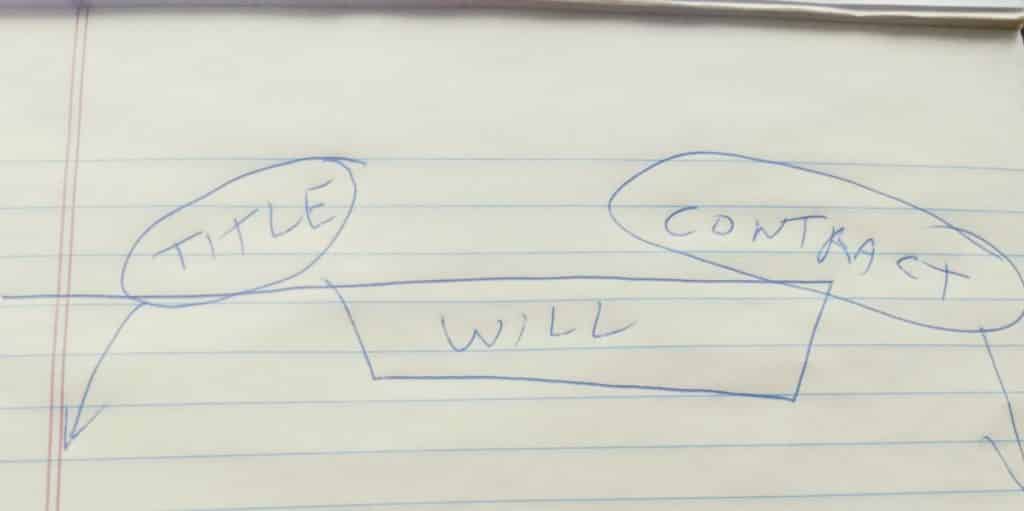

Probate is what’s left over An alternative way to avoid the Probate process, or the frying pan, is by contract. Retirement plans, life insurances and investment accounts can have transfer-on-death (TOD) or Paid-on-death (POD) instructions. These are also called beneficiary designations. The same is true for US Savings Bonds, Certificates of Deposit, and most other financial instruments. I was recently meeting with a woman whose husband had died. He had a will that gave everything to her. Unfortunately for her, all of his retirement plans were still payable on death to his first wife, who ultimately received the money. Her husband may have been under the impression that the will would redirect the accounts. That is a common mistake. Companies administering the contracts don’t care what your Last Will and Testament says: they are bound by the contract terms only. Therefore, a significant consideration in creating an estate plan is to make sure that the beneficiary designations are coordinated correctly. This going to be especially true with retirement plans. One key aspect to providing that someone inherit your IRAs and 401 K plan is providing how long they can “stretch” the withdrawal. This allows the plan to continue to grow tax deferred and spreads you the income taxes on withdrawal. How the beneficiary designations are made plays a significant part of this. We often see people who have no beneficiary or no back up beneficiary on such a plan. This can cause significant accelerated income taxing of the account. How current are your beneficiaries? With a little effort you can check and update them. Years ago, I had a client who died at age 90. We discovered that his government life insurance had been left to his wife, who was already deceased. The contingent beneficiaries were his parents. That probably made sense when he signed the life insurance papers while his children were minors. One of the biggest difficulties in the case was proving that his parents were dead. Try locating a death certificate for someone who died in the 1940s. It can be difficult, even in our internet age. One final tip: if you have minor children and have created a trust for them in your will or a revocable trust, have that trust as a primary or contingent beneficiary. Many of my clients will name a trusted sibling instead. The problem is that if the sibling dies, their family may well end up with the money.

The IRA may be liquidated quickly. An inherited IRA can provide a lot of security. However, it can also become a problem, if it is not handled correctly, according to CNBC in “Leaving an IRA to a loved one? How to avoid a tax bomb.” You can structure the distribution, so your children or grandchildren receive the best benefits. Naming a trust as an IRA beneficiary is a good way to protect large IRAs, since it provides some means of control. By naming a trust, you can protect heirs who are minors, vulnerable to creditors, not able to handle large sums of money or disabled. Trusts only need $12,750 of taxable income in 2019 to be subject to the top tax rate of 37%. If you don’t structure the trust right, you could accelerate the liquidation of the IRA at warp speed. Most people think of their spouse, when it comes to naming a beneficiary for an IRA. If your spouse doesn’t needs the funds, you should consider providing for the next generation, who will live in a world of “You’re on your own” retirement planning. IRA Trusts can also provide asset protection for beneficiaries who inherit them. Except for spousal rollovers, inherited IRAs are within the grasp of a beneficiary’s creditor, unless protected within a trust. What are the pitfalls? Not all IRA custodians allow you to list a trust on the beneficiary form. The tax code has very specific conditions, when trusts are the beneficiaries of retirement accounts. Be very careful with what you do with charities as beneficiaries. IRAs can be great tools for charitable giving, but must be handled with great care to avoid tax problems. If you fail to follow the rules, your heirs could face huge tax bills. For a trust to be viable as a designated beneficiary, it must meet a four-step test: It must be valid under your state’s laws. It must be an irrevocable trust, or one that will become irrevocable upon your death. Beneficiaries must be identifiable from the trust document. The IRA custodian or trust administrator must have received a copy of the trust by October 31 of the year after the death of the IRA’s owner. The beneficiaries must be people, not charities and not your estate. If your beneficiaries are not people, then your IRA may not have a designated beneficiary. In that case, your heirs can’t stretch the IRA by taking required minimum distribution,s based on the longer life expectancy of a child or a grandchild. Worse—if your trust fails to meet the test, it is subject to the same rules as if there was no designated beneficiary at all. That means it’ll be depleted faster than you may have wished. If you die before you start taking RMDs (70½) then the IRA must be distributed within five years after death. If you die after you start taking RMDs, then distributions pay out over what would have been your life expectancy. An estate planning attorney can advise

Estate problems can sometimes lead to a fractured family. We speak to many people who believe that if they die without a will, everything goes to the State. This is almost never the case. “Dying intestate” is the term used to describe the legal status of someone who has died without a will. The laws of your state law will then dictate what happens to your assets. Most of your tangible possessions will be distributed following probate. If your estate is complex, for example, and you own property in more than one state, the process will take a long time and the costs can be high. With a will, you can control who gets what, when they get it, and who is in control of the process. Without a will (or possibly a Revocable Living Trust), you have a plan, drafted by your legislature, but forfeit the right to decide these things. Some of your assets do not pass to heirs through a will. Jointly titled assets pass by title regardless of what your will might say. Other assets usually transfer at death by the contract that controls the asset, such as retirement accounts, life insurance policies and annuities. All accounts that have named beneficiaries go directly to the people who are named. If they predecease you, then the contingent beneficiary receives the asset. The companies do not care what your will instructs. Reconsidering your joint ownership decisions and beneficiary designations are important parts of reviewing your entire estate plan. If you name only your son as the beneficiary for your insurance policy, then later welcome a daughter into your family by birth or adoption, you’ll want to add her as a named beneficiary as well. Otherwise, when you die, only your son will receive the proceeds. Anytime a life event occurs—births, deaths, divorces, marriages—is the right time to review your beneficiary designations. You can make these changes when you are living. When you die, the designation is irrevocable. A will—and an estate plan that is updated regularly—can prevent surprises and ensure that your choices are honored. Family members can end up feeling mistreated by the distribution of an estate. However, a good estate plan can help prevent those hard feelings from developing, according to the Observer-Reporter in “Improper estate planning can lead to familial conflict.” Keeping that plan current can lessen the trauma of something happening by oversight instead of intention. Here’s a celebrity story that serves as a perfect example. A famous father made his third wife his executor and gave her total control over his business, despite the fact that his son was equally famous and the top executive in that business, as well as its public face. The son was baffled when he learned that the third wife now controlled the business, including the rights to his own name. When the father died, a long, expensive and unpleasant estate battle began. The son was Dale Earnhardt Jr. An estate planning attorney can advise you in creating

Put away the estate plan when it is completed. However, take a good look at it frequently. There are many reasons why an estate plan needs changing, because your life changes as do your goals, according to the Times Herald-Record in “5 steps to securing your elder estate plan.” What might be some of those changes? It could include your divorce, your marriage or even the marriage or divorce of your children. It can also be that your financial situation has changed, and you need to make changes. A ten-minute review at the beginning of a New Year will be an annual reminder, and can verify that you are still on the right course. The process of review may seem challenging but here are some steps to consider: Step One: gather up all your documents, which may take some time. This includes your will, powers of attorney, health care proxies, living wills, any trusts and any other documents. For clarity, here are some definitions. A will is the document that states where you want your assets to go when you die. It is reviewed by the court in a proceeding called probate, but only after your death. Assets in a living trust (or other types of trusts, depending on your situation) do not go through this process. Creating a trust results in a legal entity that owns the assets it contains. The trust assets go to beneficiaries upon death, as directed by you to the trustee. In many instances, trusts save time, money and avoid litigation over inheritances. Powers of attorney name the person you appoint to make any legal, business or financial decisions for you, should you become incapacitated. A health-care proxy names the person to make your medical decisions, if you are unable to do so. Living wills are used to express your wishes for end-of-life care. Step Two: review your documents. Make sure that everything is signed. You would be surprised how many important documents aren’t signed. Read the documents to see who was named as the executor of your will and who is the trustee of your trusts. Are those people still able to undertake these responsibilities? Do you still want them making decisions for you? Step Three: make a list of all of your assets. Note how they are titled—what names are on the accounts—and what are the values of each. Include retirement accounts like IRAs, 401(k)s, insurance policies and annuities and check to see if you named a beneficiary. Do you still want that person to be the recipient of the asset? Make sure that you have also named a contingent beneficiary. Step Four: what information would your loved ones need should you become unable to communicate? They’ll need information about your medications, the name and contact information for your primary care physician, your estate planning attorney, your CPA and your financial advisor. You may want to arrange for a “family meeting” with your healthcare team and your legal and financial team (two separate