Review Your Estate Plan in the Coronavirus Pandemic

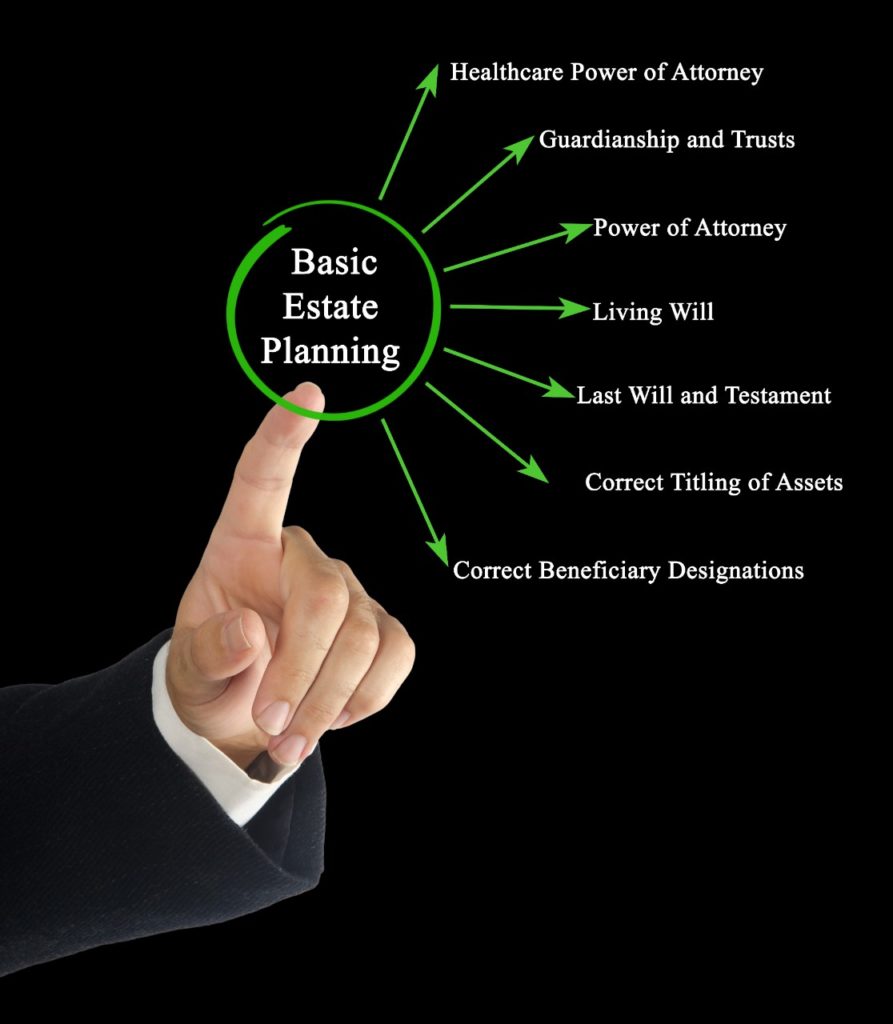

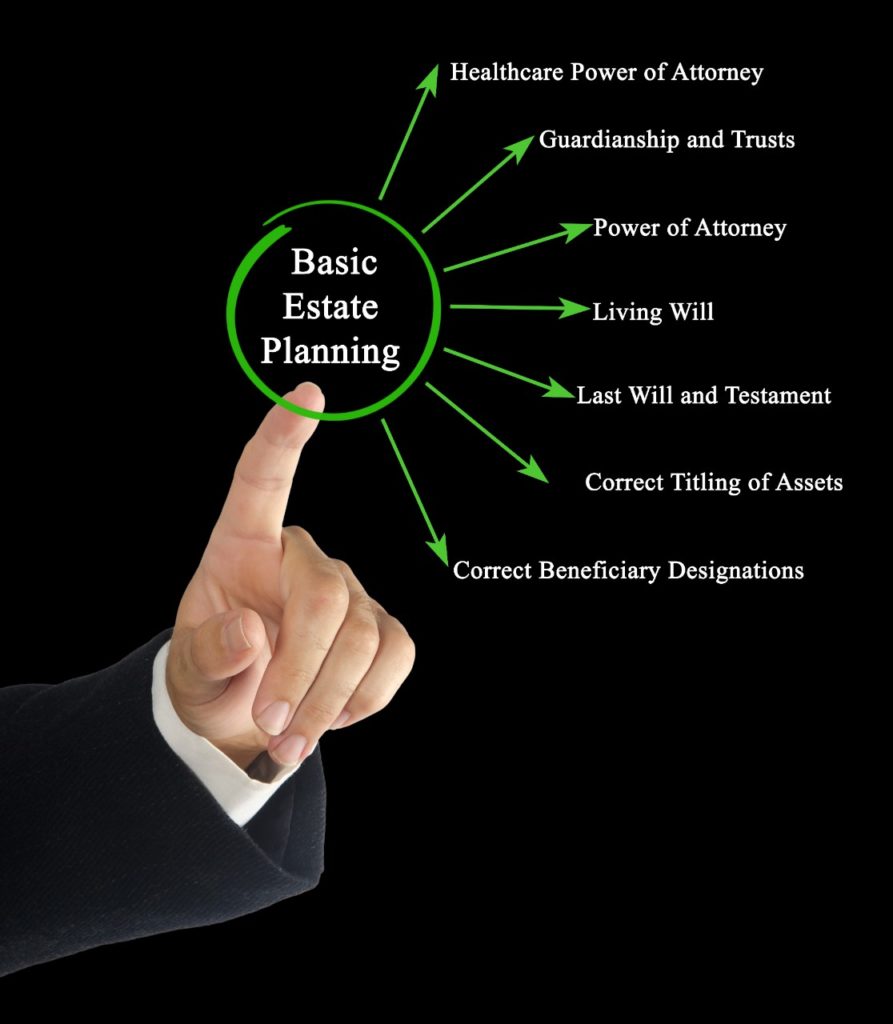

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Retirement Plans • Page 4

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.

Most consumers are familiar with the beneficiary designation form they complete when opening an IRA or 401(k). The form designates who receives the asset if the account owner dies. However, these forms can create confusion, unintended bequests, and family turmoil if not adequately monitored.

The Secure Act will force faster withdrawals from Inherited IRA Accounts.

This is a big one. The IRS would love for you to take every penny out of your 401(k) when you change jobs for one very good reason: more tax revenue.

What is the size of the average retirement nest egg? It depends on what you mean by ‘average.’

We are programmed to contribute the “max” to our retirement accounts, but we disregard, or do not understand, the pitfalls of improperly filled-out beneficiary forms.

Thanks to the Internet, everyone has the ability to draft wills, trusts, and a variety of other legal documents. Many documents can be produced for less than $100, requiring only a few mouse clicks and filled-in blanks.

One of the great things about being retired is that you no longer have a job tethering you to a particular location. You have the freedom to move. However, just because you can pick up and go, doesn’t mean it’s a good idea to go just anywhere.

Although it’s common to point out why it might make sense to delay taking Social Security benefits, there are legitimate reasons for some people to claim their benefits sooner rather than later.

The Secure Act would upend 20 years of retirement planning and stick it to the middle class.