Ignoring Beneficiary Designations Is a Risky Business

We are programmed to contribute the “max” to our retirement accounts, but we disregard, or do not understand, the pitfalls of improperly filled-out beneficiary forms.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Retirement Plans • Stretch IRA • Page 2

We are programmed to contribute the “max” to our retirement accounts, but we disregard, or do not understand, the pitfalls of improperly filled-out beneficiary forms.

The Secure Act would upend 20 years of retirement planning and stick it to the middle class.

If Congress gets its way, you’re going to lose the opportunity to help your children build wealth, and at the same time, they could end up in higher tax brackets for years.

Once your money is in a retirement account, it’s there until you’re ready to use it, right? Not exactly.

The question becomes, should they name a trust rather than an individual as a beneficiary of the IRA?

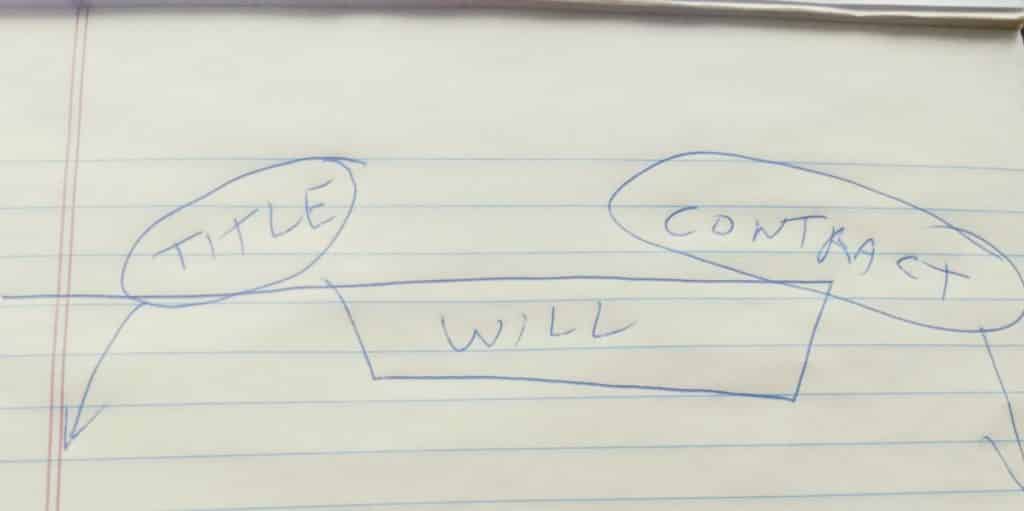

Probate is what’s left over An alternative way to avoid the Probate process, or the frying pan, is by contract. Retirement plans, life insurances and investment accounts can have transfer-on-death (TOD) or Paid-on-death (POD) instructions. These are also called beneficiary designations. The same is true for US Savings Bonds, Certificates of Deposit, and most other financial instruments. I was recently meeting with a woman whose husband had died. He had a will that gave everything to her. Unfortunately for her, all of his retirement plans were still payable on death to his first wife, who ultimately received the money. Her husband may have been under the impression that the will would redirect the accounts. That is a common mistake. Companies administering the contracts don’t care what your Last Will and Testament says: they are bound by the contract terms only. Therefore, a significant consideration in creating an estate plan is to make sure that the beneficiary designations are coordinated correctly. This going to be especially true with retirement plans. One key aspect to providing that someone inherit your IRAs and 401 K plan is providing how long they can “stretch” the withdrawal. This allows the plan to continue to grow tax deferred and spreads you the income taxes on withdrawal. How the beneficiary designations are made plays a significant part of this. We often see people who have no beneficiary or no back up beneficiary on such a plan. This can cause significant accelerated income taxing of the account. How current are your beneficiaries? With a little effort you can check and update them. Years ago, I had a client who died at age 90. We discovered that his government life insurance had been left to his wife, who was already deceased. The contingent beneficiaries were his parents. That probably made sense when he signed the life insurance papers while his children were minors. One of the biggest difficulties in the case was proving that his parents were dead. Try locating a death certificate for someone who died in the 1940s. It can be difficult, even in our internet age. One final tip: if you have minor children and have created a trust for them in your will or a revocable trust, have that trust as a primary or contingent beneficiary. Many of my clients will name a trusted sibling instead. The problem is that if the sibling dies, their family may well end up with the money.

The IRA may be liquidated quickly. An inherited IRA can provide a lot of security. However, it can also become a problem, if it is not handled correctly, according to CNBC in “Leaving an IRA to a loved one? How to avoid a tax bomb.” You can structure the distribution, so your children or grandchildren receive the best benefits. Naming a trust as an IRA beneficiary is a good way to protect large IRAs, since it provides some means of control. By naming a trust, you can protect heirs who are minors, vulnerable to creditors, not able to handle large sums of money or disabled. Trusts only need $12,750 of taxable income in 2019 to be subject to the top tax rate of 37%. If you don’t structure the trust right, you could accelerate the liquidation of the IRA at warp speed. Most people think of their spouse, when it comes to naming a beneficiary for an IRA. If your spouse doesn’t needs the funds, you should consider providing for the next generation, who will live in a world of “You’re on your own” retirement planning. IRA Trusts can also provide asset protection for beneficiaries who inherit them. Except for spousal rollovers, inherited IRAs are within the grasp of a beneficiary’s creditor, unless protected within a trust. What are the pitfalls? Not all IRA custodians allow you to list a trust on the beneficiary form. The tax code has very specific conditions, when trusts are the beneficiaries of retirement accounts. Be very careful with what you do with charities as beneficiaries. IRAs can be great tools for charitable giving, but must be handled with great care to avoid tax problems. If you fail to follow the rules, your heirs could face huge tax bills. For a trust to be viable as a designated beneficiary, it must meet a four-step test: It must be valid under your state’s laws. It must be an irrevocable trust, or one that will become irrevocable upon your death. Beneficiaries must be identifiable from the trust document. The IRA custodian or trust administrator must have received a copy of the trust by October 31 of the year after the death of the IRA’s owner. The beneficiaries must be people, not charities and not your estate. If your beneficiaries are not people, then your IRA may not have a designated beneficiary. In that case, your heirs can’t stretch the IRA by taking required minimum distribution,s based on the longer life expectancy of a child or a grandchild. Worse—if your trust fails to meet the test, it is subject to the same rules as if there was no designated beneficiary at all. That means it’ll be depleted faster than you may have wished. If you die before you start taking RMDs (70½) then the IRA must be distributed within five years after death. If you die after you start taking RMDs, then distributions pay out over what would have been your life expectancy. An estate planning attorney can advise