Reduce the Stress of Asset Transfers?

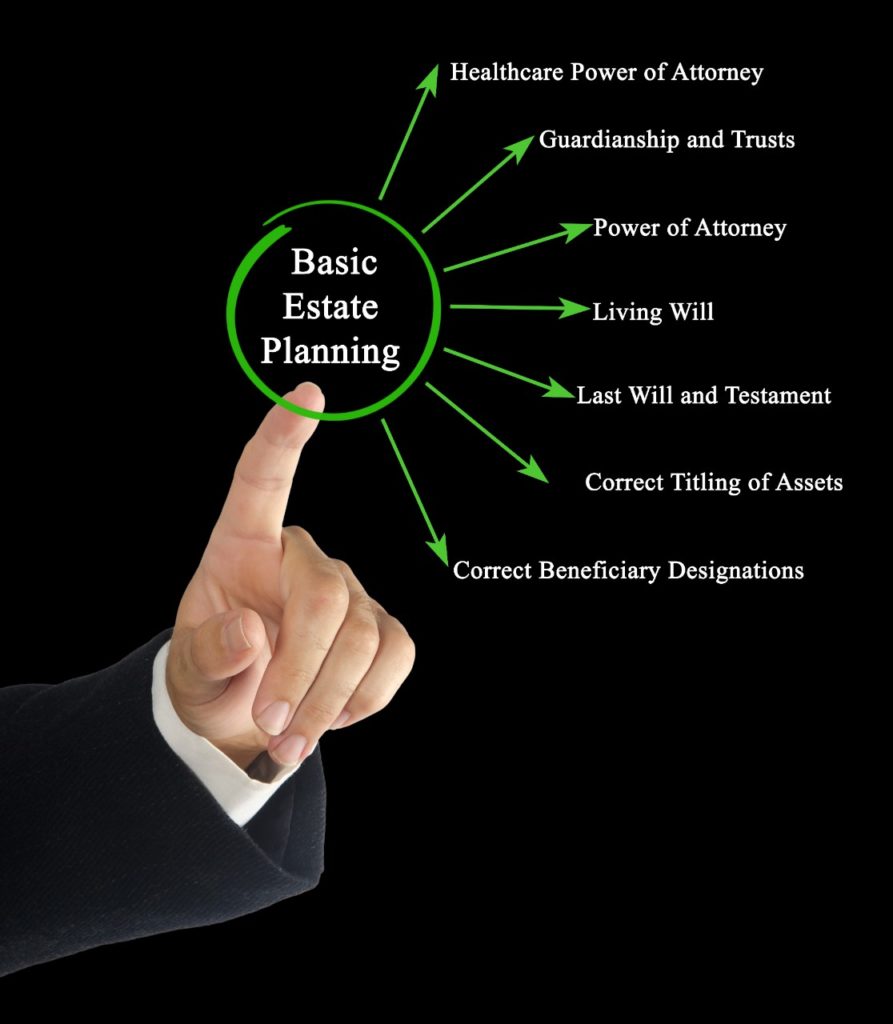

Estate planning is a cornerstone of any healthy financial plan, but it can be difficult to discuss.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Estate planning is a cornerstone of any healthy financial plan, but it can be difficult to discuss.

When someone passes away, their tax headaches don’t die with them. In fact, those obligations can further complicate the lives of survivors: Federal estate taxes may be due and state inheritance taxes could also come into play.

Per stirpes in a will means that a deceased’s child’s share will pass to the deceased’s child’s children in equal shares, if any.

Especially with the average U.S. household having $7,027 in revolving credit card debt and Americans owing a total of $416.1 billion in credit card debt, according to a recent Nerdwallet study, some Americans will have credit card debt for the rest of their lives. However, what happens to credit card debt when you die?

An unmarried couple needs to create an appropriate estate plan. If they truly want inheritance rights, they need to execute testamentary documents, such as wills.

How can we see if there was a will and if it’s worth pursuing?

Your legacy is what you leave behind: What people will remember about you and receive from your life? Legacy planning is about fostering your relationships and passing on what is most important to you for your loved ones.

There are continuing misconceptions regarding what powers are held by a personal representative and when he can exercise them.

The list of things you need to do after someone dies can seem endless, especially during a time when you are also grieving.

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.