We hope you have weathered the heat well, and have already or will soon get away for a vacation. This is also a time of year that we see many clients to review and update their plans, based on changes in the law or family circumstances.

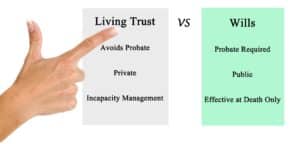

During those meetings, many of our clients with living trusts have asked if they still need a living trust. Those with will-based plans often are under the impression that trusts are no longer needed because the Federal Estate Tax and Maryland Estate Tax thresholds (11.4 Million and 5 Million, respectively) are so high that death taxes are not a big concern for most people.

When I hear people ask if they need a trust, I think it’s the wrong question. No one needs a trust. However, we don’t approach any other parenting question in this negative manner.

In my prior life, I handled divorce cases, and was occasionally asked by an uninvolved parent, “What is the minimum I need to do?” I found that to be a pitifully “bottom of the barrel” approach to parenting.

We do many things for our families and loved ones not because we need to, but because we think they are the best things that we can do. Do you need to take your children on vacations, or send them to camps or to college? We do those things because we believe they will be better off as a result. Why should the choice of the type of estate planning vehicle you choose to use be approached with a “do the minimum required” mentality?

Doing a trust and transferring assets to the trust is not, by and large, for the person who is putting that in place. It’s to make things simpler at the worst of times for their loved ones.

If you already have a trust, you have taken a great step towards managing your affairs if you are disabled, avoiding probate and preserving your privacy. If not, let me give five things you should consider.

The Top Five Things to Know About Living Trusts

There are many estate planning tools and techniques available to help an estate planning attorney design a custom plan for each client’s unique situation. One such tool is the Revocable Living Trust (RLT). The purpose of this article is to review the top five things you should know about this tool, as you evaluate your estate planning options or consider changes to your current plan. Note that this review is not meant to replace the thorough and confidential counsel of an estate planning attorney regarding your unique circumstances.

#1: An Agreement between Three Parties

Every RLT is a written legal agreement between three parties: the Trustor (also known as a Grantor, Settlor or Trustor), the Trustee and the Beneficiary. Interestingly, one person can serve as all three parties upon creation of the RLT. Note that a married couple may share one “joint” RLT and serve together as all three parties, or each spouse may create a “separate” RLT. Accordingly, the configuration of an RLT may vary depending on your unique circumstances and objectives.

Simply stated, the Trustor creates the RLT, the Trustee manages the RLT and the Beneficiary benefits from the assets titled to the RLT. While there may be multiple successor Trustees and Beneficiaries over the lifespan of any RLT, there is only one Trustor (or two, if a marital joint RLT). The “revocable” in RLT means that the Trustmaker reserves the right to change any trust provisions as long as the Trustmaker is alive and has legal capacity (i.e., is able to make decisions). Once the Trustor is deceased or no longer has legal capacity, then the RLT becomes irrevocable.

#2: Avoiding “Living Probate”

One of the unsung but major benefits of the RLT is the uninterrupted management of trust assets should the Trustor or Beneficiary lose legal capacity. The authority of a Trustee over trust assets is greater than that of an agent acting under a Durable Power of Attorney over assets still titled in the name of someone who is incapacitated. The Trustee actually holds the legal title, but the Agent is merely acting on behalf of the incapacitated asset owner who still holds legal title. Practically speaking, financial institutions clearly honor the instructions of a Trustee holding legal title, but may be reluctant when dealing with an Agent who does not.

#3: Avoiding “Death Probate”

The most commonly noted benefit to any RLT is that trust assets are not subject to probate when the Trustor dies.

Probate can be costly (2-4%), time-consuming and displays your assets in the public record. Unlike a Last Will and Testament, the RLT is typically not filed with any court. As a result, the estate distribution plan of the Trustmaker remains private, while court costs are eliminated and the delays often associated with probate are avoided. The degree to which these benefits are realized may vary depending on the state where the Trustmaker was a legal resident at the time of death. If you own real estate in more than one state, your estate may be subject to probate in each respective state. This is yet another advantage of the RLT when real estate is titled to the RLT.

#4: Funding Fundamentals

The “titling” of assets is truly the “secret sauce” when it comes to estate planning. For starters, any assets that do not have a surviving “joint owner” will be subject to probate. Similarly, any assets that do not have a designated beneficiary (e.g., transfer-on-death bank accounts, life insurance, retirement plans or annuities) will be subject to probate. And, yes, any assets that are not currently titled in the name of your RLT or do not designate your RLT as the post-mortem beneficiary will be subject to probate.

The key to the success (or failure) of any estate plan, whether passing through probate under a Last Will and Testament or avoiding probate with any RLT is this: the people who best know what they own, how it is titled, where it is located and its value are no longer alive or no longer have legal capacity. As a result, up-to-date record-keeping and careful asset titling are essential. As they say, the devil is in the details. If you don’t properly retitle assets, your estate plan could be doomed.

With a will-based plan, the work is mostly passed on to your successor, who may have less time than you to handle things went the required. Someone is going to go to the bank to move account titled, either you now or someone else later.

#5: Choosing Trustees

Along with asset “titling,” the selection of your successor Trustees will determine whether your RLT is successful. Without the Court supervision (costs and delays) of probate, you want someone who you trust to follow instructions faithfully. For added considerations on how to select appropriate Trustees for your RLT, especially the “successors” if you are the initial Trustee. Regardless, there are really three basic options when it comes to filling this crucial role.

Option A: Go with trusted family members or friends. Likely they know the strengths and weaknesses of your beneficiaries. They may not charge much, if anything, for serving. Unfortunately, they may be busy with and distracted by their own lives, financial and otherwise. Also, they may be unable to say “no” to the supplications of irresponsible trust beneficiaries.

Option B: A professional Trustee, such as an institution or a CPA, is a common choice. The upsides and the downsides are the opposite of those noted in Option #1. They will not run off with the money, but will probably be more expensive and less personal.

Option C: Consider combining Options A and B for the best of both. Under this “pro-am” approach, the family member (or friend) Trustee understands the strengths and weaknesses of your Beneficiaries, while the professional Trustee can say “no” to irresponsible distributions. In the process, personal relationships are preserved and Beneficiaries are protected.

Final Thoughts

If you are thinking that RLT planning is complex, then you are right. Just like you would not perform major surgery on yourelf, you should not attempt to create your own RLT without a professional. However, doing the legwork yourself now with a trust can make things significantly easier later.

Find Us Online

If you know someone who could benefit from putting their affairs in order, please introduce us. Through estate planning, business planning, and asset protection, our firm will help you protect everything you love — family, friends and favorite charities. For more information be sure to visit our web site where you will have access to our blog, events schedule, and a complimentary newsletter subscription!

Copyright © Integrity Marketing Solutions. All Rights Reserved.