Some Estate Planning Steps for 2020

This time of the year is a great time to revisit your estate plan so you can ensure your legacy is protected for years to come.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Asset Protection • Page 3

This time of the year is a great time to revisit your estate plan so you can ensure your legacy is protected for years to come.

An issue that frequently arises is the treatment of an inheritance received by a spouse during the marriage. The basic rule is that any property received via gift or inheritance during the marriage is exempt from equitable distribution.

There’s a lot of prep work to complete when you’re expecting a new baby. Expectant parents have a nursery to paint, strollers to buy, doctor’s appointments to attend, and nannies to hire.

Generally, when settling an estate, debts and expenses are paid first, charitable and spousal transfers follow, and applicable estate taxes are levied afterward.

The ex-husband of Amy Winehouse is making a $1.4 million legal claim on her estate —eight years after her death.

Liz Hurley’s son Damian has won a legal fight against his grandfather who tried to cut him out of his inheritance.

Do not put off finalizing and signing your estate planning documents just because you have reached an impasse on who to name as trustee.

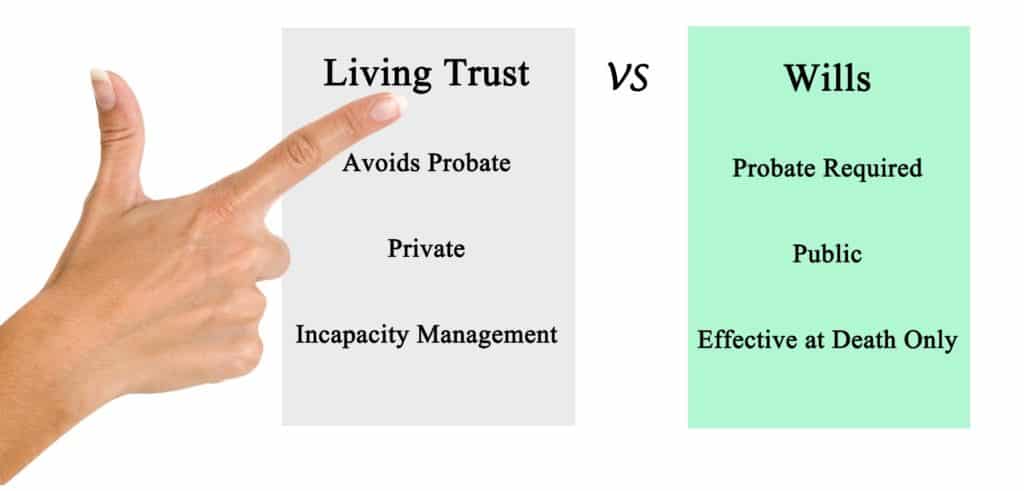

A trust can be a vital component in an estate plan.

What is the difference between a prenup and a postnup? Do you need one? And if so, which is the right fit for your marriage?

There’s a misperception that estate planning is only for the ultra-wealthy.