46 Year Old Zappos CEO Died with No Will

If you pass away without a will, state law generally decides who gets your assets and, if you have children, who will care for them.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

If you pass away without a will, state law generally decides who gets your assets and, if you have children, who will care for them.

Personal property is a unique category of asset. Even in the simplest after-death distribution, personal property can become a hindrance to final distribution. There are a couple of reasons why.

When dealing with the emotional pain of the loss of a loved one, family members also have to address daunting administrative tasks.

There are continuing misconceptions regarding what powers are held by a personal representative and when he can exercise them.

The list of things you need to do after someone dies can seem endless, especially during a time when you are also grieving.

The period leading up to and shortly after losing a close relative is often one of the most emotionally demanding times that we, as humans, experience.

One problem that frequently stems from the inheritance process is fractured relationships between siblings. Unfortunately, the common denominator in many of these situations is the parents’ estate plan.

Take, for example, the sad and sordid tax case of Mary Ellen Cranmer Nice vs. United States of America, which would not have existed if an attentive financial advisor hadn’t noticed the large IRA distributions that were allegedly stolen right from under a matriarch’s nose.

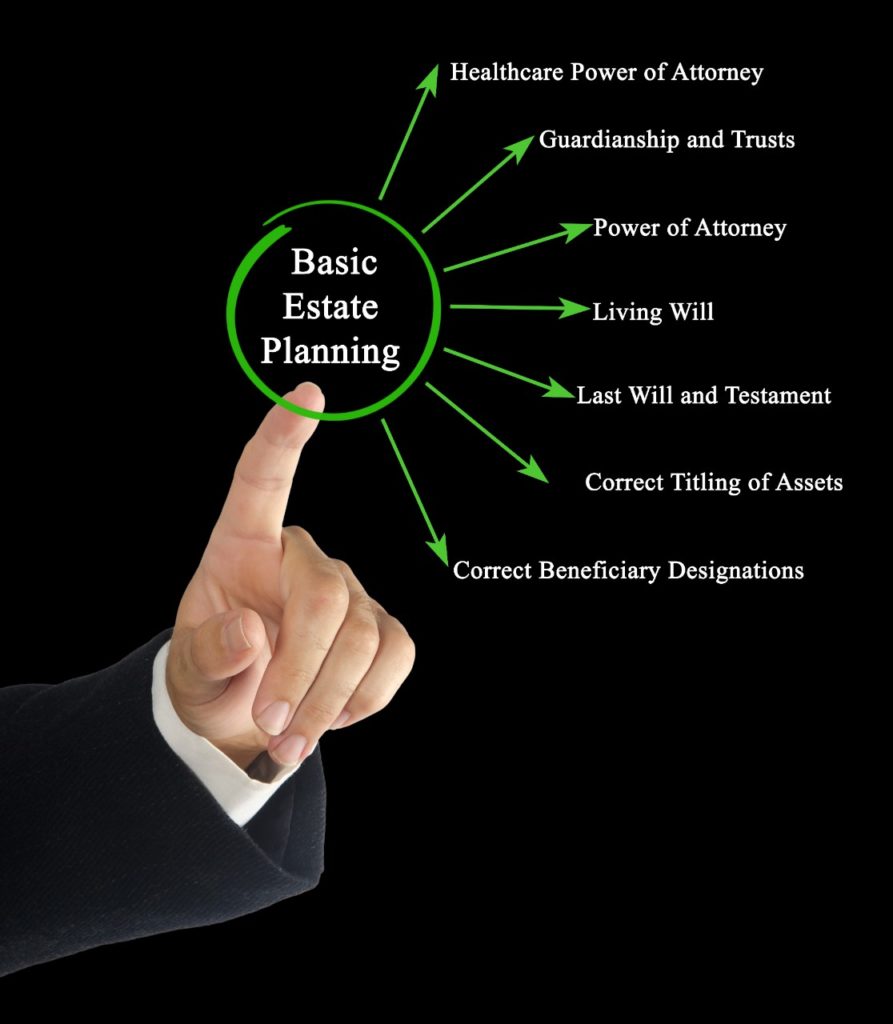

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.

When a member of your family dies, you could be left to pick up the financial pieces. Finding all the information you need can be challenging.