Am I Named in a Will? How Would I Know?

How can we see if there was a will and if it’s worth pursuing?

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Home • Probate Court • Page 2

How can we see if there was a will and if it’s worth pursuing?

There are continuing misconceptions regarding what powers are held by a personal representative and when he can exercise them.

The period leading up to and shortly after losing a close relative is often one of the most emotionally demanding times that we, as humans, experience.

When you open a financial account, you’re often asked to name a beneficiary. Simply stated, a beneficiary is someone who is entitled to the benefits of the account on the death of the account holder. For example, if you’ve purchased life insurance, you name a beneficiary who receives the benefits of the policy when you pass away.

The heirs to Henry Ford II – the eldest grandson of legendary Henry Ford – filed a legal challenge against their late patriarch’s attorney, Frank Chopin, who is now the champion of Ford’s widow, Kathleen DuRoss Ford, 80.

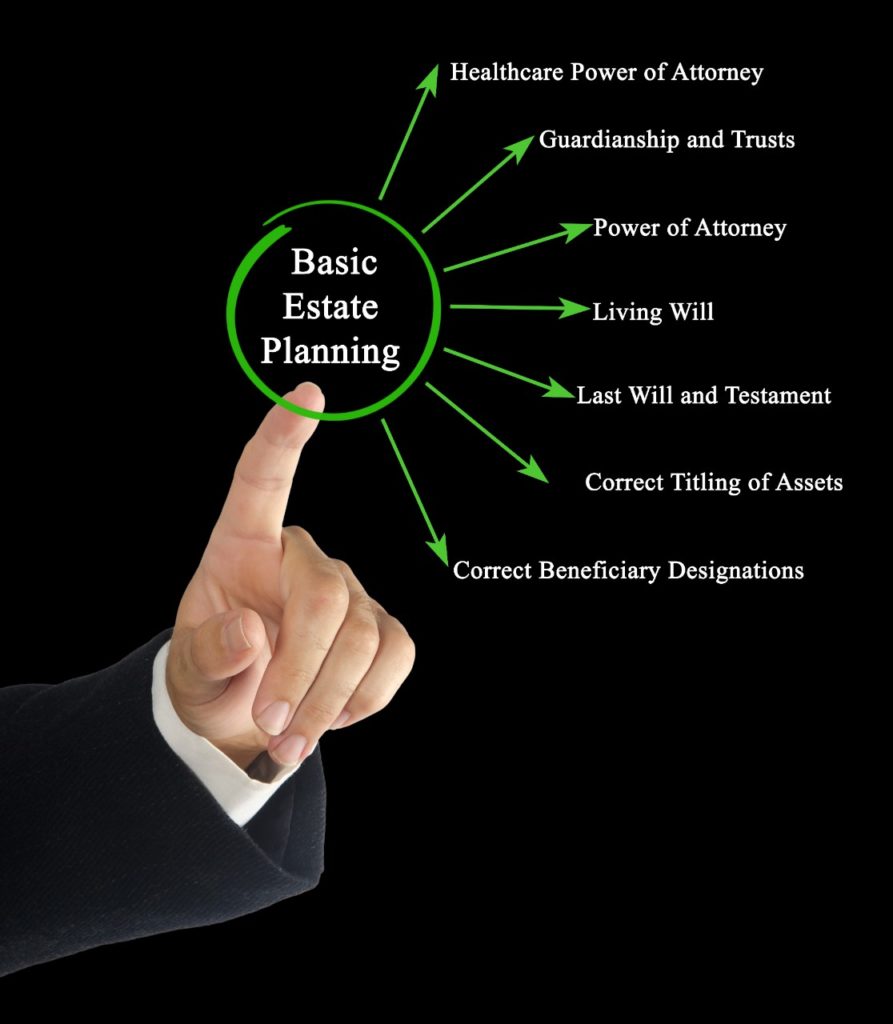

Many people are taking this time at home during the COVID-19 crisis to update their estate plan. Here are six critical estate plan components you should focus on in light of the current pandemic.

Most consumers are familiar with the beneficiary designation form they complete when opening an IRA or 401(k). The form designates who receives the asset if the account owner dies. However, these forms can create confusion, unintended bequests, and family turmoil if not adequately monitored.

The COVID-19 crisis isn’t just costing Americans their freedom and jobs; it’s also forcing millions to contemplate their own mortality.

Aretha Franklin’s niece, Sabrina Owens, has resigned as executor of the late soul singer’s estate amid mounting family tensions, the Detroit Free Press reports.

Sometimes, despite best intentions and best efforts, an estate plan leaves unintended problems for heirs, trustees, and others to solve. For example, a trust may have become outdated because of changes in tax laws, the birth or death of family members, or special circumstances, like an heir’s disability.