How to Make Beneficiary Designations Better

Beneficiary mistakes can result in retirement plan assets being transferred to unintended beneficiaries.

Call us Anytime

Laurel, MD 20707

Downs Law Firm, P.C.

Beneficiary mistakes can result in retirement plan assets being transferred to unintended beneficiaries.

Probate and trust administration are not the same. There are important differences and similarities between administering a decedent’s probate estate and administering a decedent’s trust estate.

The world exists just as much online as it does offline. Failing to recognize that when planning for the end of life can lead to unexpected repercussions for survivors.

Bradford Lund tries to prove he is mentally capable of managing his affairs but is trapped in a probate system susceptible to predators.

We have all heard the term “probate.” However, we may not be exactly sure what this means. It may sound daunting, but don’t be intimidated by the phrase.

It was reported on the news recently that some of Aretha Franklin’s family members have found what they believe to be her will. It was handwritten, stained, and crumpled up in a couch. The courts may or may not choose to honor it, depending on whether or not they are able to verify its authenticity.

When a loved one dies leaving property, debts and a mortgage, and if he did not have a living trust, probate is required to sort everything out.

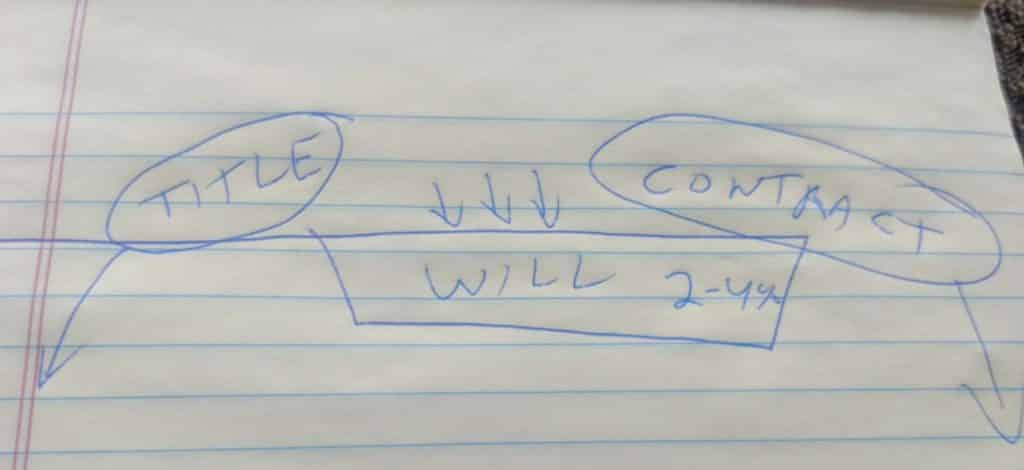

Probate is what’s left over At the end of the day, there may be some things left over to go through probate, meaning they didn’t avoid the process by title or contract. What’s so bad about that? I don’t know that there’s anything so terrible about probate. It is a necessary process to transfer title of property if no other options have been exercised. People who I have worked with in the Probate Court are generally helpful and dedicated. The Court imposes deadlines which make the case move through the system. However, the two main reasons people want to avoid the probate court, or any other court process are money and time. I often here attorneys say that probate is not that bad in Maryland. Actually, I only hear attorneys say that. In Maryland there are various court costs, bonding fees, probate fees, and attorney’s fees as well as Personal Representative’s commissions. The highest of these fees are often attorney’s fees. What’s so bad about that? The allowable fees for attorneys and Personal Representatives are combined is about 3.6% of the assets. For example, suppose the deceased person has a house worth $300,000 and a mortgage of $250,000, which figure is used to calculate the allowable fees and commissions? The formula is based on the gross assets, not the net assets. The allowable commissions and fees for a $300,000 probate are $11,880. In this example, the allowable fees are 24% of the net value ($11,880/$50,000). I generally estimate 2% to 4% as the administrative expenses for most families in probate. Additionally, probates ordinarily take somewhere between 9 months and 18 months to complete. If assets are complicated in nature, the time could be much longer. For small Estates, meaning under $50,000, the process can be much shorter. An additional reason some of my clients want to avoid probate is that your Last Will and Testament is a public record. Someone going to the Courthouse can read your Will, see the values of all the assets passing through the court system, learn the timing of distributions, and find out who gets what and when to they get it. This is more information than some many of my clients want to share with the public.

Probate is what’s left over I draw about ten frying pans a week on a legal pad. This is not due to my great artist ability. Last week I explained that Wills work through a process called Probate. When someone dies, property may be transferred by title, such as the transfer of a house to a spouse when the first spouse dies. It is easy and essentially automatic. If a person dies and the title doesn’t convey ownership, then a contract may do so instead. More about that next week. There are only three ways assets transfer at death: By Title, by Contract, or by Probate. If the title and contract don’t transfer ownership, then a probate estate does. If a decedent as a will, this is activated then: if not, then the law of the state of they lived in writes one for them. Since the dead person is not here to transfer title, that role is given to the Personal Representative. Once appointed, that person can sign contracts, deeds, tax returns, etc. All this is done with the oversight of the probate Court. Probate is not bad: it serves a necessary function. Many year ago, I was part of a bar association discussion years ago about probate and its avoidance. I was advocating the use of Revocable Living Trusts as reasonable alternatives to Court supervised transfers. I felt like a baby harp seal hunter at a PETA meeting. The outrage and venom directed at me for suggesting that Probate was to be avoided” were palpable. Most of the lawyers present, and the then Register of Wills, insisted as a strong refrain that “Probate is not that bad…” The only people I have heard insist that this is true are attorneys and Probate Court personnel. I pointed out the hypocrisy of this by position by asking “How many of you have your life insurance policies and/or retirement plans payable to their probate estates?” Of course, no one did so, because naming a beneficiary was simple and the probate Court could be avoided. If probate isn’t so bad, then why no? Maybe because of administrative fees, Court costs, Attorney fees, Personal Representative Commissions, which in Maryland can be 3.6% to 4%. Maybe because the court process can cause long delays before funds are available: from seven months to several years is not unusual. Finally Probate records are public, meaning that your neighbor can go to the Court, read your will, find out who is getting what, when they get it, and who is in control. For some of my clients, keeping this private is preferable. Is short, probate is time consuming, expensive and is completely public. The Court process provides supervision, which is some cases is badly needed. Most of my clients name people that they trust and don’t want supervised. To weigh out your options, its best to seek the advice of an estate planning attorney. Note: This is the Second of a Series of Five to be published

Administrating an estate or trust? Let’s take a look at just how hard it can be. People often name a family member or close friend as an executor or trustee. However, sometimes it is wise to think it through and consider the possibility of a professional administrator as a trustee, according to Kiplinger in “Why You May Need a Pro Trustee: Trust Administration is Not Just Common Sense.” The article details some of the problems that can arise despite good intentions. Let’s call our client Linda. She wants to identify a successor trustee. Linda’s parents had identical estate plans with trusts that were set up for Linda and her two siblings Jack and Diane. Linda was the family’s responsible one, so she received her share in each estate outright and served as the trustee for the other separate trusts, two for Jack and, two for Diane since the second of her parents died some 10 years ago. This is not unusual—parents will often give the responsible person in the family, the role of the trustee when their siblings are seen as less likely to perform the necessary tasks. These four trusts were close in value, with about $440,000 in each. They were identical in other ways: the trustee had the power to pay from income and principal each year for the beneficiary’s health, maintenance and support, but there was no requirement to distribute anything. Linda had done a great job, in keeping with her reputation. For 10 years she recorded every transaction. Because she knew her siblings resented her serving as trustee, she never paid herself a fee. Linda was tired, and she wanted to let someone else be in charge of the trusts. When the trusts were presented to an institutional trust officer, it was clear why the trusts had never been merged. Linda’s mom had executed an amendment to the estate plan after Linda’s dad died that ensured that when these siblings passed (that would be Jack and Diane), the trusts would pass to their descendants. Linda’s mom executed this amendment so that when Jack and Diane passed away, the trust from the mother would be divided among her surviving children. This meant that Linda would get another share, and Jack and Diane’s children would get less benefit from that trust. Linda’s mom thought she was doing a good thing. However, her decision put Linda in a bad position. She became an “interested” trustee, with the power to make decisions that would eventually put more funds into her pockets or diminish her share. Of course, that would only happen, if she outlived her siblings. Linda had been diligent and responsible, insuring that the trusts had the exact same asset allocation and investments, paying out income from the trust and when one called asking for money, giving both the same additional amount from the mother’s trust and the father’s trust, even though any distributions made from the mother’s trust make her less likely to receive a larger share in