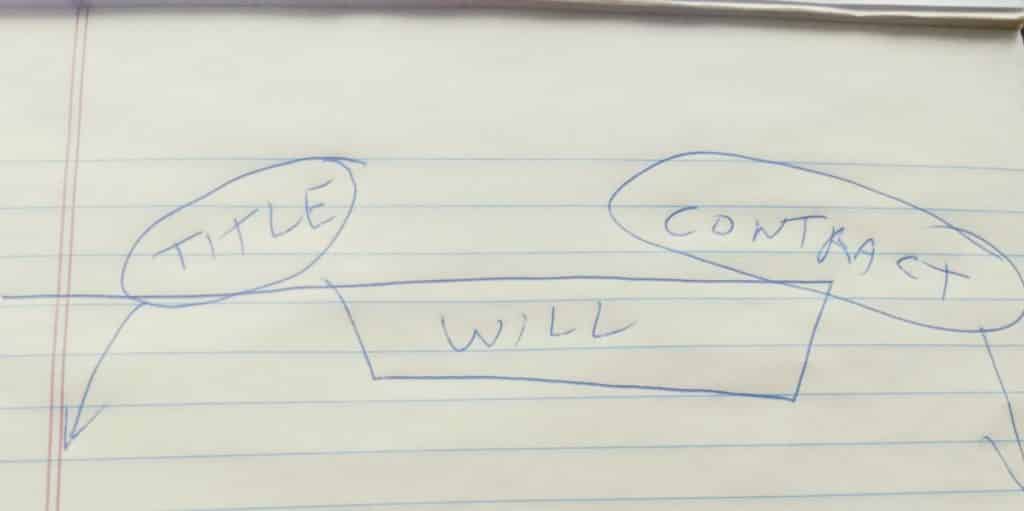

Probate is what’s left over

An alternative way to avoid the Probate process, or the frying pan, is by contract. Retirement plans, life insurances and investment accounts can have transfer-on-death (TOD) or Paid-on-death (POD) instructions. These are also called beneficiary designations. The same is true for US Savings Bonds, Certificates of Deposit, and most other financial instruments.

I was recently meeting with a woman whose husband had died. He had a will that gave everything to her. Unfortunately for her, all of his retirement plans were still payable on death to his first wife, who ultimately received the money. Her husband may have been under the impression that the will would redirect the accounts. That is a common mistake.

Companies administering the contracts don’t care what your Last Will and Testament says: they are bound by the contract terms only. Therefore, a significant consideration in creating an estate plan is to make sure that the beneficiary designations are coordinated correctly. This going to be especially true with retirement plans.

One key aspect to providing that someone inherit your IRAs and 401 K plan is providing how long they can “stretch” the withdrawal. This allows the plan to continue to grow tax deferred and spreads you the income taxes on withdrawal.

How the beneficiary designations are made plays a significant part of this. We often see people who have no beneficiary or no back up beneficiary on such a plan. This can cause significant accelerated income taxing of the account.

How current are your beneficiaries? With a little effort you can check and update them. Years ago, I had a client who died at age 90. We discovered that his government life insurance had been left to his wife, who was already deceased. The contingent beneficiaries were his parents. That probably made sense when he signed the life insurance papers while his children were minors.

One of the biggest difficulties in the case was proving that his parents were dead. Try locating a death certificate for someone who died in the 1940s. It can be difficult, even in our internet age.

One final tip: if you have minor children and have created a trust for them in your will or a revocable trust, have that trust as a primary or contingent beneficiary. Many of my clients will name a trusted sibling instead. The problem is that if the sibling dies, their family may well end up with the money.