Probate is what’s left over

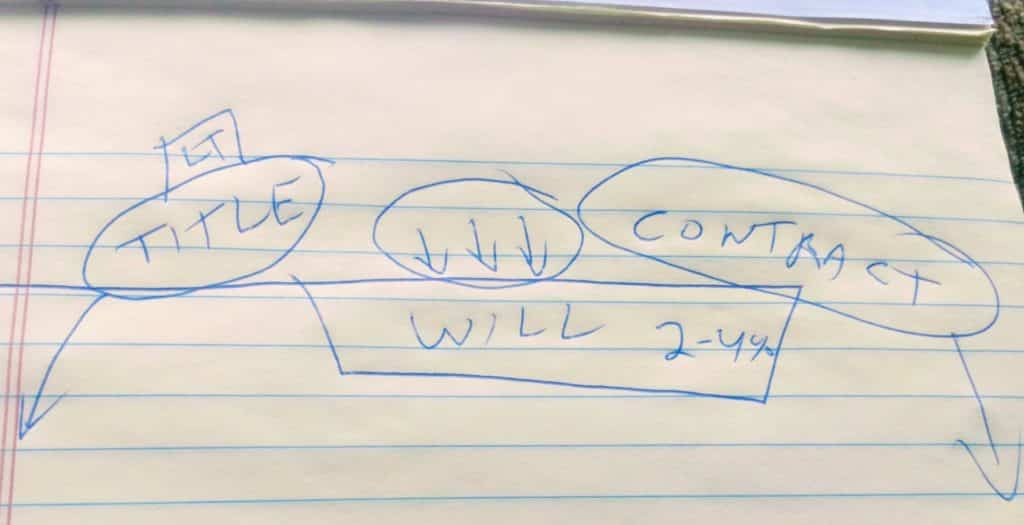

When someone dies, property will be transferred from them to someone else by Title or Contract.

One form of trust transfer is a Revocable Living Trust. When I think of a Trust, I picture a “Box” to take the title of the property. Assets transferred into the trust, or “Funded into the Trust”, do not need to be transferred through the probate process, because the death of the Trust creator does not affect the title of the property.

The idea is to put the property into the box while you are alive. If you do so, where is the title when you die? It’s in the Trust, just as it was before death. Probate is not needed to help change title.

However, a Living Trust is not a magic box. It will only avoid court for assets that are transferred to it. To avoid Court, you must do work: you need to dedicate the time, effort and persistence required to transfer the titles.

For most banks, account numbers stay the same. The checks don’t need to say “Trust” on them as long as the statements do. The account will still be in your social security number, as the trust is not separate taxpayer while the Grantor is living.

Not all assets get funded into a Trust. Assets such as Life Insurance, retirement plans, deferred compensation accounts, thrift savings plans, and annuities are handled by beneficiary designation and are not transferred into a revocable trust. Automobiles are not usually transferred into a Trust.

We estimate that most of our clients spend 20 to 30 hours on the funding process, mostly in filling in new account forms and waiting for bank personnel to figure out how to do what you are asking.

You can take consolation in this: if you don’t go through this effort, your chosen loved one who is named executor will be doing so. A large part of the gift a trust represents to the family is that you spend the time and effort, so they don’t have to. It also means revising deeds so that the titled owner is the Trust.

When someone dies, we meet with the successor trustee, and are focused on what the titles say, and who are designated beneficiaries on the contracts. That is where the rubber meets the road.

What if things are missed. We create a short will, called a “Pour over Will” to catch loose ends which get missed in the funding process. The Will simply says “Put the probate assets into the trust” in legal mumbo jumbo.

To use this type Will, you need to go to the probate court and open a probate filing. In Maryland, for estates of under $50,000, the process is relatively simple and is often opened and shut on the same day.

A significant added bonus to a living trust is that is works very well to allow management of assets if you are no longer able to do so. But that’s a topic for another day.

I hope you have found my simple drawing helpful. Thanks for joining in.